Why your next date night should be a ‘money date’

Money conversations don’t have to be awkward. A ‘money date’ helps you and your partner unpack what money really means to each of you, beyond budgets and bank accounts.

Money might not be the most romantic topic, but it’s one of the most important. Finances were the primary reason for relationship conflict in 40% of disagreements reported among people in long-term relationships.

Whether you’re newly dating, living together, or have been married for years, talking about money reveals a lot about how you both see the world.

In their book Eight Dates, relationship experts Dr. John Gottman and Dr. Julie Schwartz Gottman suggest having a ‘money date’. This is time set aside to discuss what money really means to you and your partner. Drawing on forty years of research, they show that these conversations aren’t about who spends too much or saves too little. They’re about understanding each other’s stories, values, and dreams.

Basically, talking about money helps you understand each other better.

Money can be tricky because it’s never just about numbers. It’s about security, freedom, independence, and even love. We all bring our own experiences to the table, shaped by how we grew up and what money represented in our families.

Maybe you were taught that saving equals safety, while your partner sees money as a tool for adventure and fun. Neither is wrong. But if you don’t talk about those differences, it’s easy to start pulling in opposite directions.

A ‘money date’ helps you slow down and have these conversations.

Use the Wealthbit Money in Relationships (Money Date) workbook - part of our Financial Freedom Programme™ - to help you have honest, meaningful conversations about money, values, and shared goals.

We built this as a tool to guide you through your ‘money date’. It helps you reflect on:

- Your personal and shared history with money - the good and the bad

- How your associations and emotions shape your financial habits

- Ways to make your money attitudes more compatible

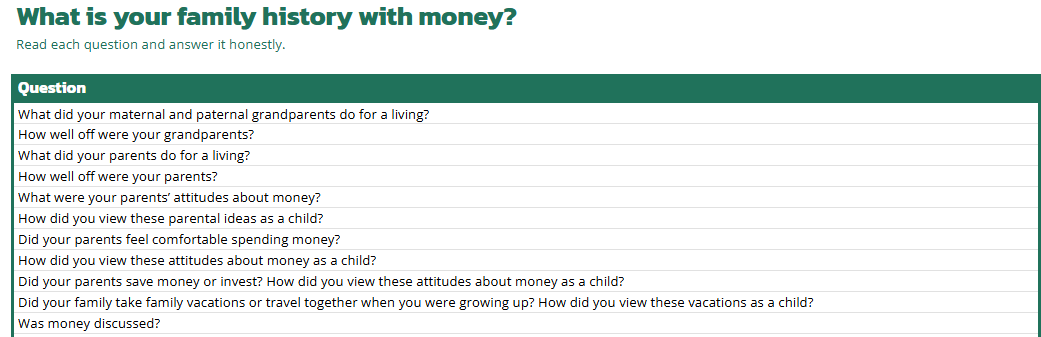

Your family history with money

Before your money date, take a few minutes to reflect on your financial upbringing.

What did you learn about money growing up? How did your parents handle it: openly, secretly, or not at all? What were your parents’ attitudes about money? Was money discussed? How did your parents show you that they were proud of you? Or didn’t they?

It’s important to think about the money messages you grew up with and how they shape your habits today.

Go to your workbook.

Go through the questions and jot down your answers. You’ll revisit them during your money date, where they’ll form the foundation for your discussion about your personal and shared history with money.

As you think them through, notice how old patterns might still be shaping the way you handle money today.

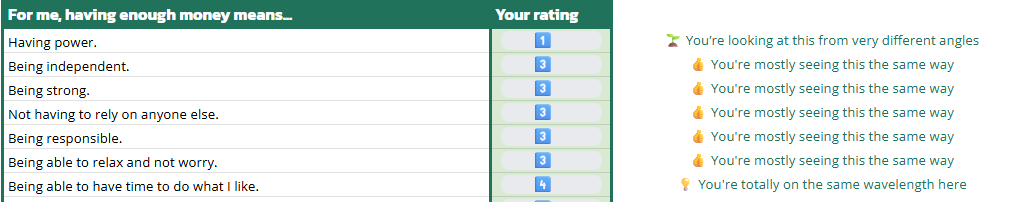

What does “enough money” mean to you?

Understanding what money means to you is an important part of building a healthy relationship with it and creating better habits around it.

Move on to the next exercise.

This section helps you define financial comfort and explore what “enough” really looks like for you.

Once you’ve added your ratings, you’ll gain insights you can compare with your partner during your money date to see where you align and where your views on money differ. For example: You’re looking at this from different angles vs You’re mostly seeing this the same way.

From these questions, you might notice, for example, that money means security to you but fun and adventure to your partner.

What habits do those beliefs create for each of you?

And how can understanding these differences help you better support one another moving forward?

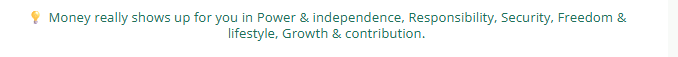

You’ll also get a summary of what having enough money means to you (see below). Compare it with your partner’s to make sure you understand each other’s point of view.

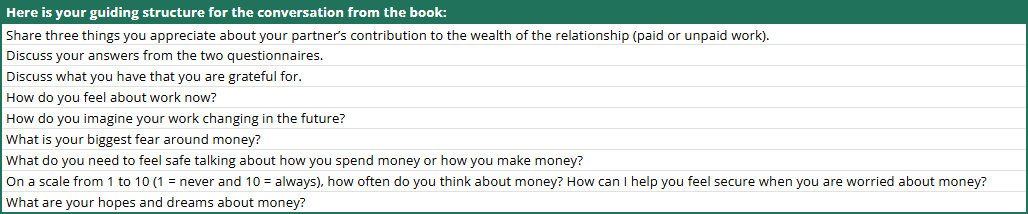

Set your money date agenda

You’ve written down your reflections from exercises 1 and 2 and taken some time to prepare mentally.

Now comes the fun part: your money date.

Choose a time when you’re both relaxed, make a cup of tea (or pour a glass of wine), and use the Gottmans’ prompts as your guide.

Remember, this date isn’t about fixing or judging. It’s about understanding what money means to each of you and finding ways to make your money attitudes more compatible.

Having a loose structure helps take the pressure off. It’s not about winning or convincing; it’s about listening and learning from each other’s reflections.

Start by discussing your answers from exercises 1 and 2, then move on to the prompts for deeper conversation.

By taking the time to understand what money means to you both, you’re not just managing finances, you’re building trust, empathy, and a shared vision for your future.

Sign up for Wealthbit’s Money Systems newsletter and make financial freedom simple.

Related content:

Money habits email course: Create a system that sticks

Build a budget that reflects your life, not just your bills: A simple guide

How to spend guilt-free and make space for real-life things: A practical workbook

How to build practical money habits in 3 simple exercises