How to help your employees use their money to build the life they want

Show your team how to use their money in ways that matter. This workbook helps employees set goals, feel more in control, and plan for the life they want.

Many people believe that earning more will help them achieve their goals. But more money doesn’t always lead to less stress.

Even high earners at your company might feel overwhelmed – and that stress affects their focus, productivity, and loyalty.

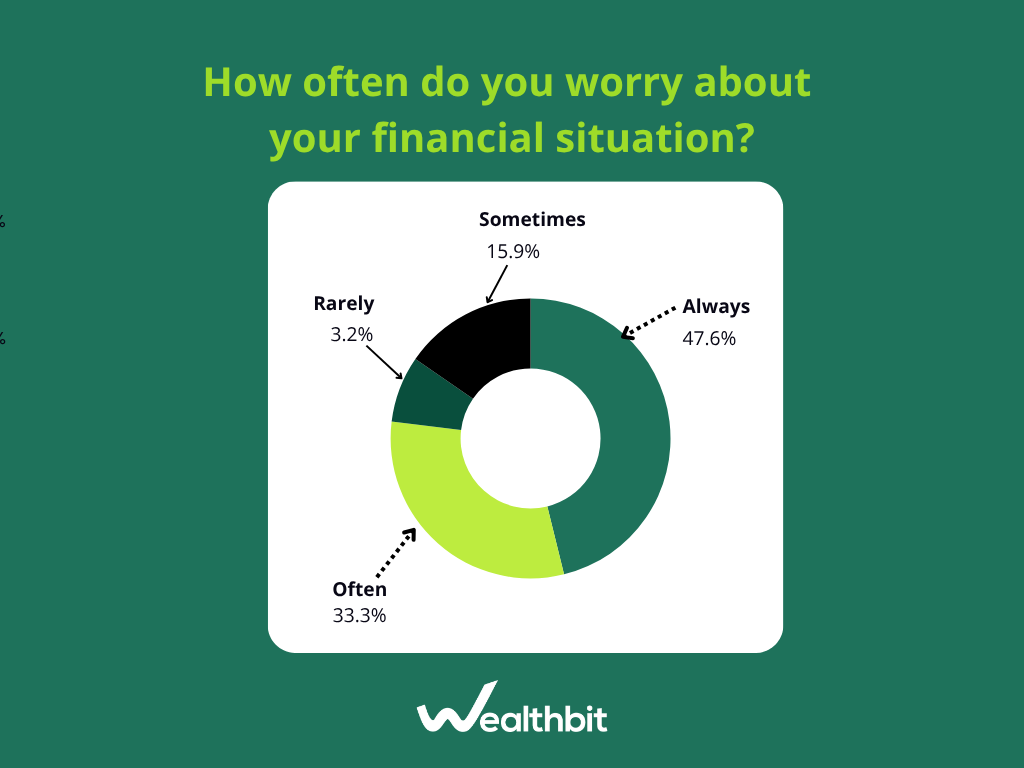

In a recent Wealthbit workshop, we asked participants to rate how stressed they feel about money. The results were scary:

Money alone isn’t the answer. What matters is how we use it.

So how can your company support employees to feel more in control of their money?

The Wealthbit Life Goals Workbook is a simple, self-led tool that helps people reflect, reset, and plan how to use their money in ways that matter.

👇 Get the workbook for your team:

Weighing the positives vs the negatives

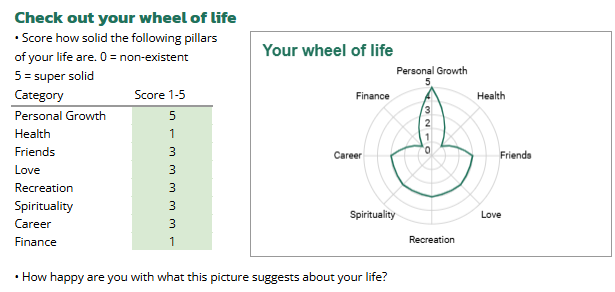

The ‘Wheel of life’ activity in the workbook helps employees reflect on key areas like career, health, fun, and relationships.

It’s a simple way to see what’s going well in their lives – and which areas might need more attention.

As they rate each area, a shape forms that gives them a quick snapshot of how balanced things feel.

This quick exercise links everyday life to financial planning, helping them take the next step with confidence.

Guide your employees to reflect on what matters most

Once employees complete the ‘Wheel of life’ exercise, the next step is reflection.

Is there one area that clearly needs more TLC? That’s often the best place to start.

Then, shift the focus to the future.

In the ‘Vision of your life’ section of the workbook, employees can compare their current path with the life they’d ideally like to lead.

It’s a powerful way to visualise what financial freedom means to them – and why it’s worth planning for.

They’re prompted to imagine their life five years from now:

- Where are they waking up?

- What’s around them?

- What’s the first thing they do?

- How do they feel?

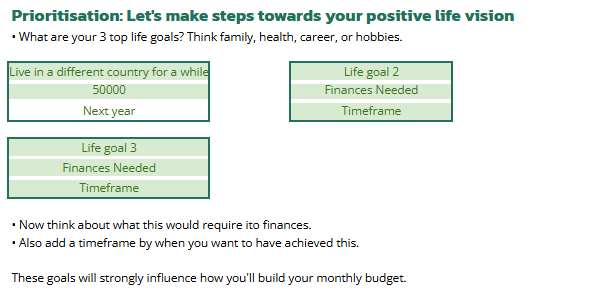

From there, they name their top 3 life goals.

What do they want to achieve? Will it require money? If so, how much?

They’ll estimate whether each goal is short-term (1–3 years), mid-term (3–10), or long-term (10+).

It’s a simple but great way to help your team connect their day-to-day decisions with the bigger picture.

Help your employees identify what’s getting in the way

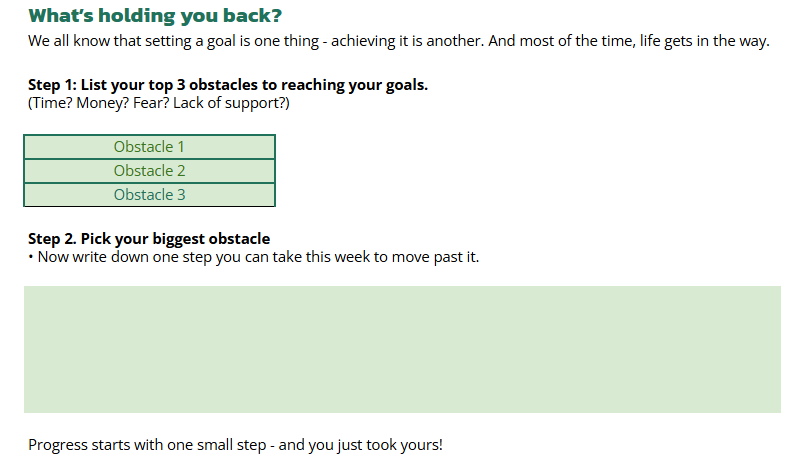

Once employees have named their top goals, the next step is to look at what might be holding them back.

Is it money? Time? Uncertainty? Naming the blockers is the first step to moving past them.

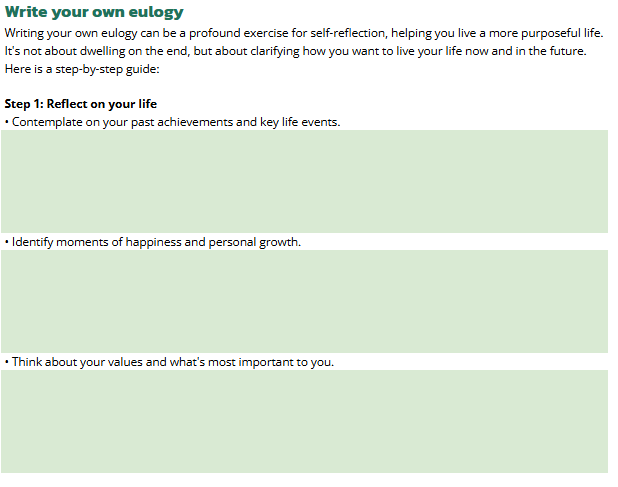

Then comes a deeper reflection exercise – writing their eulogy (yes, really!).

It might sound intense, but it’s a very good way to get clarity, fast.

By imagining how they want to be remembered – what they stood for, what they built, how they lived – employees can cut through the noise and focus on what matters now.

It’s often where meaningful change begins.

This exercise encourages big-picture thinking and helps your team align their financial decisions with their life goals.

Give your employees the tools to take action

By the end of the workbook, employees will have a clearer picture of what matters to them – and what’s getting in the way.

They’ll leave with a simple plan to start using their money more intentionally.

From here, they can begin building a budget that supports the life they want, not just the life they’ve defaulted to.

It’s a simple first step toward better money management – and a meaningful way your company can support long-term well-being.

This workbook complements our Financial Freedom Programme, which includes workshops with more tools, coaching and a mobile app, giving your team a solid foundation to reduce stress, grow savings and move towards financial freedom, on their terms.

Sign up for Wealthbit’s Money Systems newsletter and make financial freedom simple.